1.

Form a relationship with a real estate agent that specializes in properties with land in your area of interest and with a lender that can help you with an appropriate loan. If you are considering a government-sponsored loan like a USDA, Federal Housing Administration or Department of Veterans Affairs mortgage, seek out a lender that has experience with those programs. Your real estate agent may be able to help you find one.

2.

Add up your monthly gross income, which is all of the money that you make from various sources, before any taxes. You’ll use this number to calculate your debt to income ratio.

3.

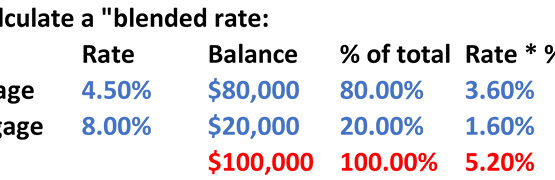

Provide your income to your lender so that he can calculate your maximum home mortgage amount. One rule of thumb, used by both the FHA and USDA, is that your mortgage payment can’t exceed 29 percent of your monthly income and your total debts can’t exceed 41 percent, although there may be some room to go above those numbers. If you have a fixed income of $2,500 per month, for instance, your maximum mortgage payment will be $725 and your total debt payments can’t exceed $1,025 per month.

4.

Work with your real estate agent to find a house that you can afford within the limit set by your debt to income ratio. If you can’t find a house that fits in with your limit, you can mitigate a mortgage payment that is too high by putting more money down, if you have it. Another solution if your debts are too high outside of your mortgage is to pay down those other debts and eliminate monthly payments, freeing up more of your fixed income to go towards your mortgage.

5.

Place a house that meets your needs under contract with the help of your real estate agent and complete your lender’s application process. Generally, you’ll need to document your income, allow the lender to check your credit and wait for an appraisal to confirm the value of your house. If you choose to use a USDA loan, you won’t need to put anything down and you can finance your USDA guarantee fee. FHA loans require at least 3.5 percent down.

Steve Lander has been a writer since 1996, with experience in the fields of financial services, real estate and technology. His work has appeared in trade publications such as the “Minnesota Real Estate Journal” and “Minnesota Multi-Housing Association Advocate.” Lander holds a Bachelor of Arts in political science from Columbia University.

[…] Click here to view original web page at homeguides.sfgate.com

How to Buy Land & a Home on a Fixed Income