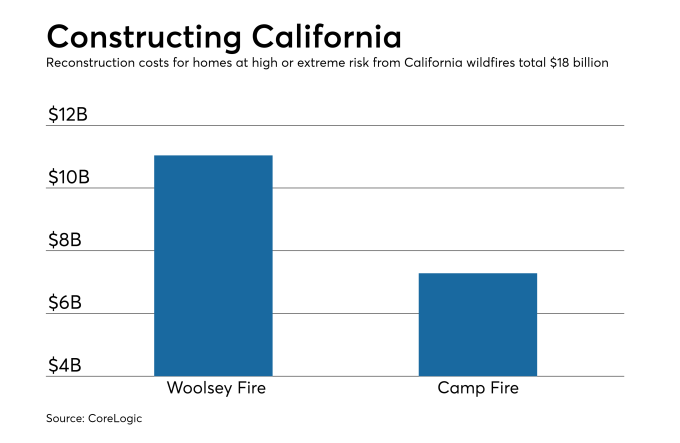

The Camp Fire, which has Northern California up in flames, is putting an estimated 31,394 homes, with a total reconstruction cost value of about $7.3 billion, at high or extreme risk as of Nov. 11. Southern California’s Woolsey Fire, affecting areas from Thousand Oaks to Malibu, is putting 16,996 homes at extreme or high risk, with a reconstruction cost value of $11 billion.

The 48,390 homes dubbed at extreme or high risk from the California wildfires burning through the state could cost $18 billion in reconstruction, according to a CoreLogic analysis.

The CoreLogic Wildfire Risk Score evaluates potential dangers to a property by considering slope, aspect, vegetation/fuel and surface composition, and the proximity of a home to higher risk areas that could affect it via windblown embers, according to the company.

Homeowners may halt payments for up to 12 months without incurring late fees and without being reported to the credit bureaus, according to Fannie Mae and Freddie Mac natural disaster relief policies. Servicers may suspend or reduce mortgage payments for up to 90 days without first having contact with the homeowner. Servicers must also suspend foreclosure or legal proceedings for properties believed to be affected.

Click here to view original web page at www.nationalmortgagenews.com