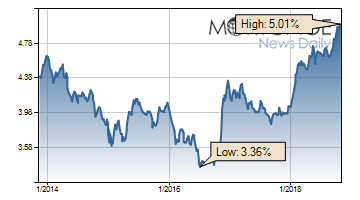

Mortgage rates surged last week thanks to an exceptionally strong jobs report. Even though there wasn’t anything as threatening in the current week, rates failed to make much progress back in the other direction.

Investors were focused on election results where the Democratic victory in the House temporarily helped rate early in the week, but the benefit was short-lived. The Fed released its policy announcement without making any major changes. Some investors hoped they’d acknowledge the recent market volatility. When they didn’t, both stocks and rates lost ground.

All this may be much ado about nothing, however, as the net effect of this week’s trading was effectively a “pass” from both sides of the market. After the 3-day weekend, there will be some important inflation data next Wednesday that could serve as the next major cue for interest rates.

Mortgage rates had a bad week and an especially bad day following a much stronger-than-expected jobs report. The Employment Situation (the most important piece of labor market data and arguably the most important economic report as far as interest rates are concerned) showed the highest pace of wage growth since before the recession and a surprisingly robust addition of new jobs in October. Strong jobs data is the nemesis of low interest rates and today was no exception.

Click here to view original web page at www.mortgagenewsdaily.com